27+ percent of income mortgage

Web However if another borrower earning the same income doesnt have a car loan a student loan or credit card debt they might be able to afford a mortgage. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Ad 5 Best House Loan Lenders Compared Reviewed.

. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Compare Lenders And Find Out Which One Suits You Best. Explore Quotes from Top Lenders All in One Place.

Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. Ad 5 Best House Loan Lenders Compared Reviewed. Web How much of your income should go toward a mortgage.

Compare More Than Just Rates. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. Begin Your Loan Search Right Here.

Compare Lenders And Find Out Which One Suits You Best. Explore Quotes from Top Lenders All in One Place. Keep your mortgage payment at 28 of your gross monthly income or lower.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Ad Calculate Your Payment with 0 Down. Begin Your Loan Search Right Here.

Compare Offers Side by Side with LendingTree. Web Among owners age 80 and over 27 percent were carrying mortgage debt in 2019 compared with 3 percent in 1989. Or 45 or less of your after-tax net income.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Compare Mortgage Options Get Quotes. Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage.

Ad Need Help Calculating Your Mortgage Payment. Web This number means that 27 of our pre-tax income goes to housing costs. Web For example if you make 3500 a month your monthly mortgage should be no higher than 980 which would be 28 percent of your gross monthly income.

Web The Bottom Line. Lenders prefer to see a debt-to. Ad Get the Right Housing Loan for Your Needs.

How much house you can afford is also. Ad Get the Right Housing Loan for Your Needs. Even before the pandemic a record number.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Get Started Now With Quicken Loans.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. Save Real Money Today.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Try Our Free Tool Today. Web A mortgage payment now costs 31 of the typical American household income according to Black Knight.

Lenders prefer you spend 28 or less of your gross monthly. Compare Offers Side by Side with LendingTree. Web Your debt-to-income ratio matters when buying a house.

Find A Lender That Offers Great Service. The 2836 rule is a good benchmark. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. Thats up from 24 in December and the highest. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web Typically lenders cap the mortgage at 28 percent of your monthly income. Looking For a House Loan. Evaluate The Results At this point an underwriter knows that our example gross monthly.

Apply Now With Quicken Loans. When it comes to calculating affordability your income debts and down payment are primary factors. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you.

Comparisons Trusted by 55000000. Comparisons Trusted by 55000000. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web What percentage of income do I need for a mortgage. Keep your total monthly debts including your mortgage. Ad Compare Mortgage Options Calculate Payments.

No more than 28 of a buyers pretax monthly income should go toward. Web Factors that impact affordability. Looking For a House Loan.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Cmp 13 07 By Key Media Issuu

What Percentage Of Income Should Go To Mortgage Banks Com

Affordability Calculator How Much House Can I Afford Zillow

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

27 Affordable Care Act Statistics And Facts Policy Advice Policy Advice

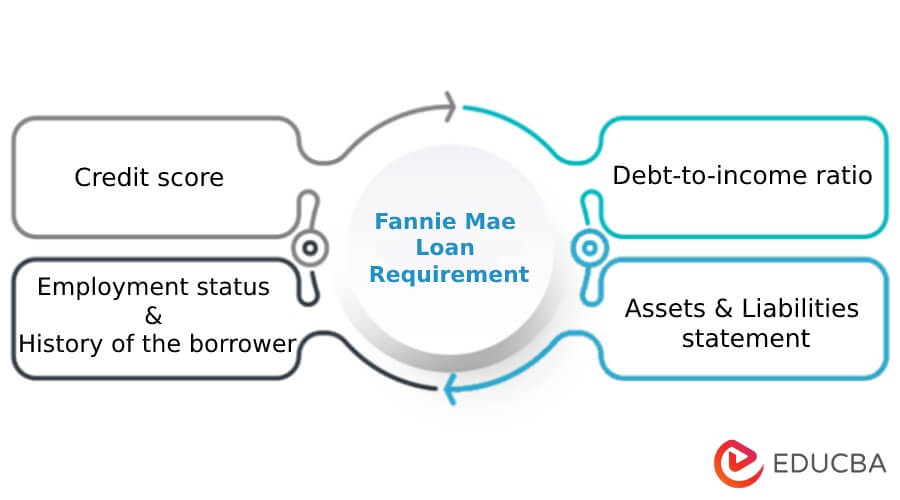

What Is Fannie Mae Purpose Eligibility Limits Programs

What Percentage Of Your Income To Spend On A Mortgage

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

Smart Ass Condo Math Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

What Percentage Of Income Should Go To A Mortgage Bankrate

Non Qme Pompano Beach Fl

What Percentage Of Income Should Go To Mortgage

The Percentage Of Income Rule For Mortgages Rocket Money

Per Loan Mortgage Profits Hit Record High In Q3 2020 National Mortgage News

The Income Required To Qualify For A Mortgage The New York Times